Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. To better illustrate merchandising activities, let’s follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. I am new to accounting and need to make Chart of Account for an Inventory Management Information System. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Best Account Payable Books of All Time – Recommended

Even though the quantity of inventory is the same, the cost has changed. All such events related to returned goods are documented in the final accounts as they have a monetary impact. Depending on a transaction’s terms and conditions, goods purchased both in cash and credit may be returned. When merchandise is returned to suppliers or a price adjustment (allowance) is requested, the buyer usually contacts the supplier in writing. This written information is called a debit memorandum or debit memo. Purchase Returns Account is a contra-expense account; therefore, it can never have a debit balance.

Treatment of Purchase Returns in the Financial Statements

CBS decides to keep the phones but receives a purchase allowance from the manufacturer of $8 per phone. Both Merchandise Inventory-Phones increases (debit) and Cash decreases (credit) by $18,000 ($60 × 300). This entry is very similar to the entry used under perpetual inventory, but instead of Inventory we use Purchase Returns and Allowances. Essentially, we are reversing a portion of the original purchase journal entry.

Stay up to date on the latest accounting tips and training

Remember, the rules for perpetual and periodic inventory still apply so we will look at both cases here. We will also look at the transactions from the seller times interest earned ratio calculator pricing strategy consultant and buyer’s perspectives. To have an up-to-date inventory report helps companies to run their accounting and logistics departments without hassle.

Recording a Retailer’s Purchase Transactions

- Now, let’s look at the entry from Whistling Flute’s perspective.

- The purchase returns and allowances accounts exist due to the accruals concept in accounting.

- Usually, the purchase process begins with a company identifying the need to buy raw materials or finished goods.

- When paying for inventory purchased on credit, we will decrease what we owe to the seller (accounts payable) and cash.

- Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses.

However, other companies may have a pre-approved list of suppliers from which they purchase goods. Upon delivery, Y Merchants found that the merchandise was defective and, therefore, could not sell it to customers. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

What is the purpose of purchase returns and allowances journal?

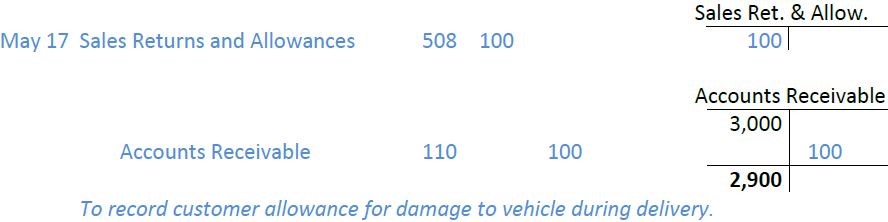

But instead of entering in your Cash account, you credit your Accounts Payable account. A purchase return, or sales return, is when a customer brings back a product they bought from a business, either for a refund or exchange. No matter how great your products are, you’re bound to have purchase returns at some point or another. Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 – $1,500 – $120).

Sometimes goods purchased by a business are unfit for use and may need to be returned to the respective supplier(s). This may happen due to several different reasons, in business terminology, this action is termed purchase returns or return outwards. Journal entry for purchase returns or returns outwards is explained further in this article. A company, ABC Co., made total purchases of $500,000 during the last accounting period. The company recorded these purchases in its books using the following journal entries. When it returns these goods to the supplier, the accounting entries may differ.

To illustrate the perpetual inventory method journal entries, assume that Hanlon Food Store made two purchases of merchandise from Smith Company. Debit The amount owed to the supplier would have been sitting as a credit on the accounts payable account. The debit above cancels the amount due and returns the suppliers balance to zero. In the case of purchase returns, it can be seen that goods are returned to the supplier and subsequently recorded in General Ledger under the account of Purchase Returns. If a customer made a cash purchase, decrease the Cash account with a credit.